Hood (HOOD) breaks out as robinhood pushes prediction markets higher

Stock sits near record after 4b contracts milest

I’m looking at Robinhood (HOOD) right now because the stock just broke into record territory - touching $142.48 before easing back a bit. The catalyst? A mix of prediction market growth, possible overseas expansion, and the SEC’s push on blockchain-based stocks.

Fundamentals

On the fundamentals side, Robinhood’s prediction markets are scaling faster than I expected. Vlad Tenev said they’ve already handled 4 billion contracts, with half of that volume just in Q3. That kind of growth is eye-catching because it shows strong user demand and gives HOOD a shot at building a new recurring revenue stream outside of its core brokerage model. If they can push into markets like the U.K., it could open up another growth leg - though regulators abroad may treat this as gambling, not finance.

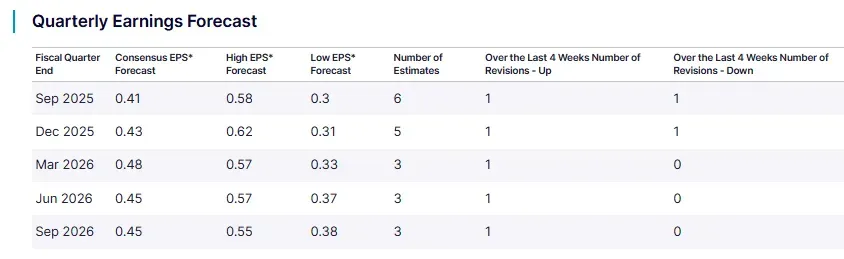

Recent EPS surprises highlight the strength of momentum:

• Jun 2025: reported $0.42 vs forecast $0.31 (+35.5%)

• Mar 2025: reported $0.37 vs forecast $0.31 (+19.4%)

• Dec 2024: reported $0.54 vs forecast $0.42 (+28.6%)

• Sep 2024: reported $0.17 vs forecast $0.18 (-5.6%)

Technicals

Technically, the chart looks strong. HOOD cleared resistance around $135 and is holding near $139-$140. If it can maintain above that zone, the setup points toward continuation. The fact that sentiment on Stocktwits flipped from bearish to neutral with rising chatter suggests retail is slowly warming up again. If broader momentum in fintech and crypto stays intact, I could see a run to retest the highs.

Bigger Picture

The bigger picture adds another angle: the SEC’s plan to allow tokenized stock trading could play right into Robinhood’s strengths. They’ve already been vocal about real-time settlement, and if they get early-mover advantage in tokenized equities, that could strengthen their competitive moat versus legacy brokers. Of course, there’s pushback from Wall Street giants like Citadel, which means delays and regulatory battles are possible.

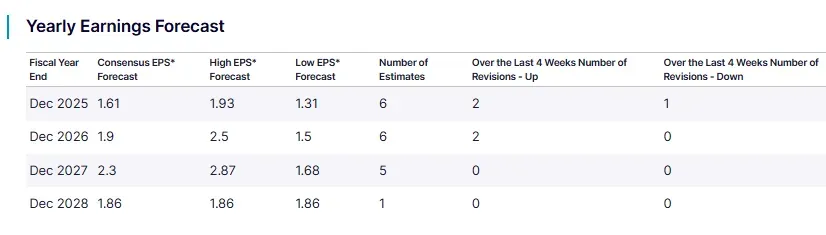

Analyst yearly EPS forecasts stand at:

- Dec 2025 = 1.61

- Dec 2026 = 1.90

- Dec 2027 = 2.27

- Dec 2028 = 1.86

My take

I’m bullish here. The fundamentals are showing new growth engines, the technicals back the move, and the regulatory catalysts - while messy - give Robinhood optionality that most brokers don’t have. Near-term pullbacks are likely after a big run, but I see dips being bought as long as the $130-$135 support holds.

Be the first to comment

Publish your first comment to unleash the wisdom of crowd.